sales tax oklahoma tulsa ok

The total tax rate might be as high as 115 percent depending on local municipalities. Tulsa Sales Tax Rates for 2022.

The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is 852.

. Depending on local municipalities the. State of Oklahoma - 45. 5921 E Admiral Pl.

The average cumulative sales tax rate between all of them is 828. Sales Tax in Tulsa. Tulsa County 0367.

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. Other local-level tax rates. The calculator will show you the total sales tax amount as well as the.

The Oklahoma state sales tax rate is currently 45. With over 20 years of accounting and bookkeeping experience AQ Financial handles your books and taxes so you dont have to. SOLD MAR 28 2022.

Nearby homes similar to 3012 N Tulsa Dr have recently sold between 81K to 385K at an average of 125 per square foot. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Sales tax exemptions apply to Interstate 1-800 WATS and interstate private-line business telecommunication services and to cell phones sold to a vendor who transfers the equipment.

As far as all cities towns and locations go the place with. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. City 365.

What is the retail sales tax in Oklahoma. Oklahoma Sales Tax Application information registration support. What is the sales tax rate in Tulsa OK.

The latest sales tax rate for Tulsa OK. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365. This rate includes any state county city and local sales taxes.

State of Oklahoma 45. How much is tax by the dollar in Tulsa Oklahoma. Integrate Vertex seamlessly to the systems you already use.

2483 lower than the maximum sales tax in OK. Ad Automate Standardize Taxability on Sales and Purchase Transactions. This rate includes any state county city and local sales taxes.

Oklahoma sales tax details The Oklahoma OK state sales tax rate is currently 45. 5320 N Tulsa Ave Oklahoma City OK 73112 163900 MLS 1023652 Great opportunity tri-level with basement living space or bedroom. 3 beds 2 baths 1776 sq.

2020 rates included for use while preparing your income tax deduction. This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates.

Ad New State Sales Tax Registration. The Oklahoma sales tax rate is currently. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. Inside the City limits.

Avalara provides supported pre-built integration. 2020 rates included for use while preparing your income tax deduction. Tulsa County - 0367.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The current state sales tax rate in Oklahoma OK is 45 percent. You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code.

The latest sales tax rate for Tulsa County OK. The most populous location in Tulsa County Oklahoma is Tulsa. 215000 Last Sold Price.

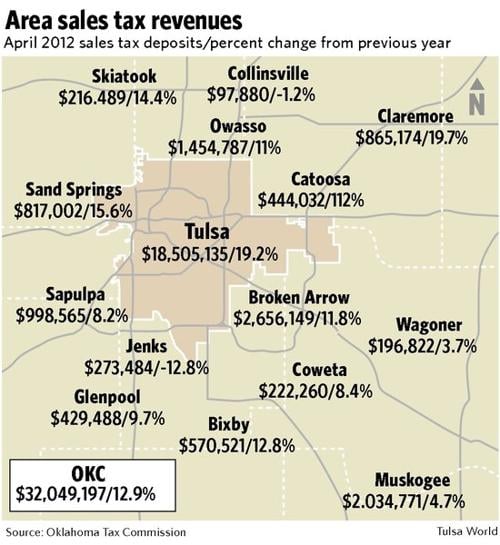

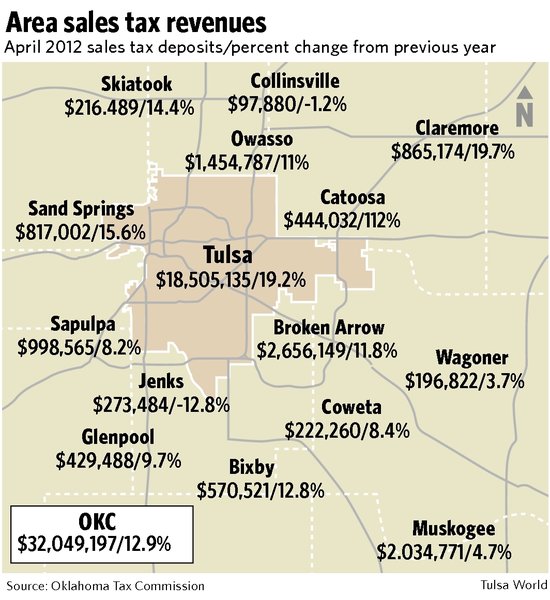

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Total Sales Tax Per Dollar By City Oklahoma Watch

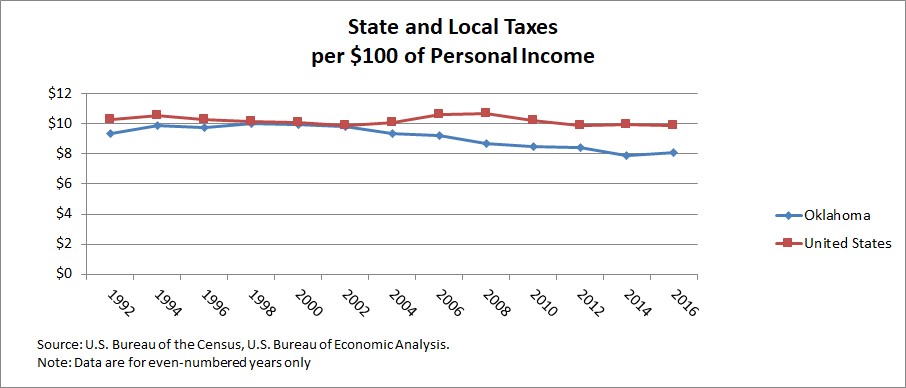

Oklahoma Tax History Oklahoma Policy Institute

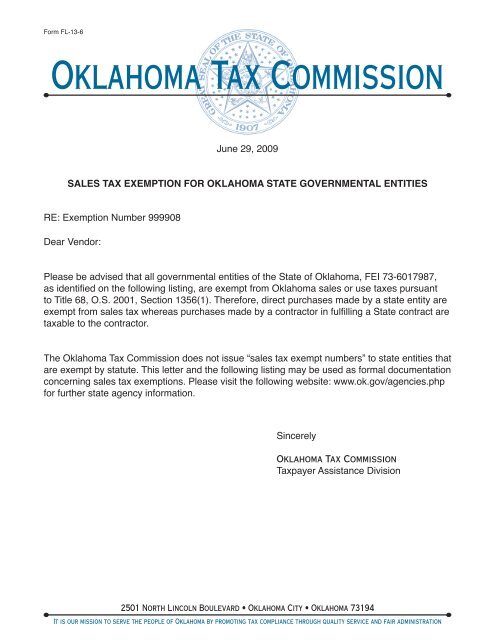

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

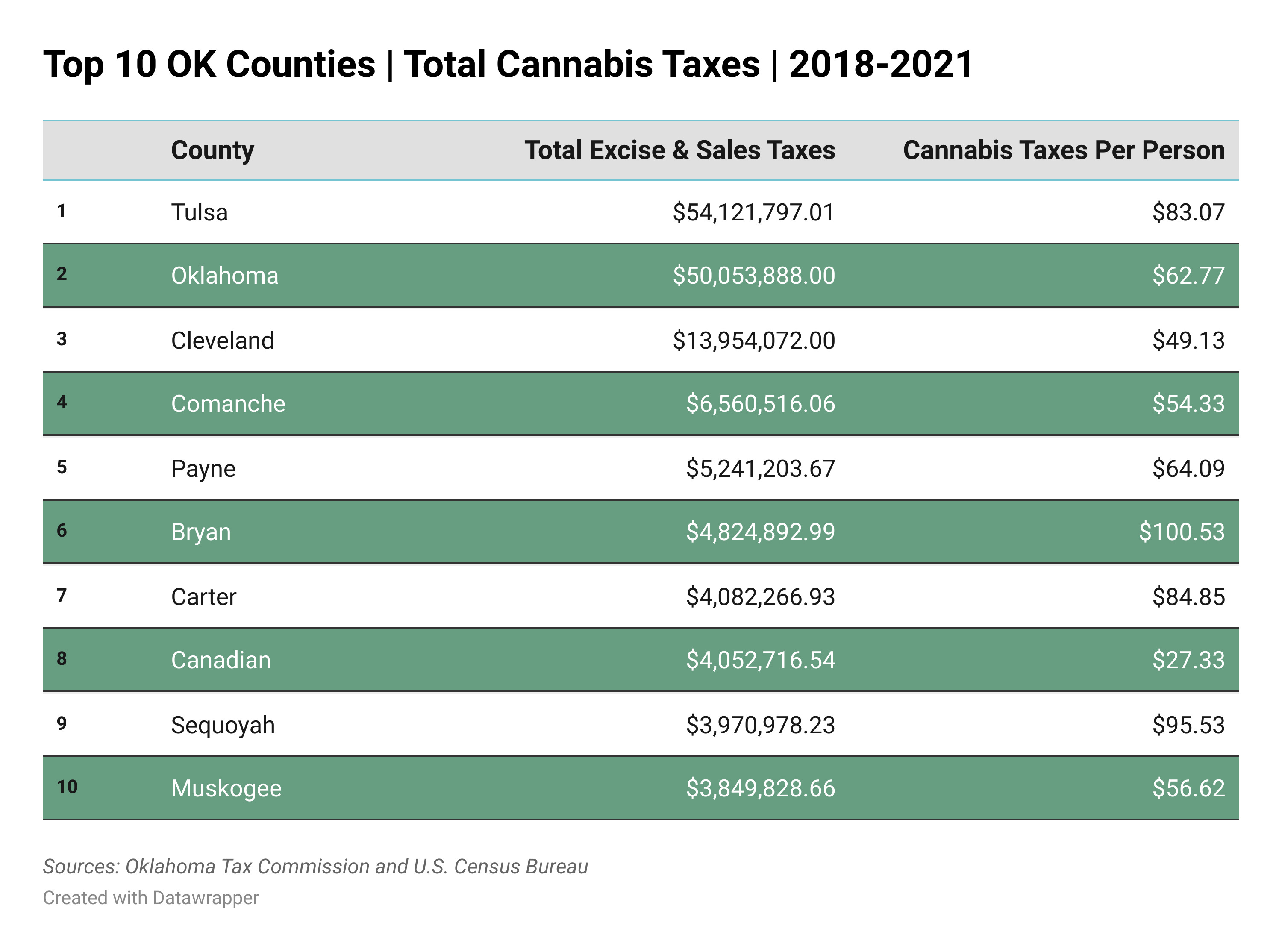

Districts Of Ok Lawmakers Targeting Cannabis Generated 27 5m In New Weed Taxes

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Oklahoma Lawmakers Discuss Eliminating State Sales Tax On Groceries

Oklahoma Sales Tax Small Business Guide Truic

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

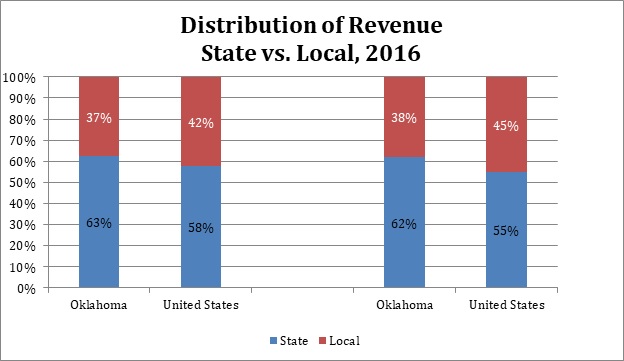

State And Local Tax Distribution Oklahoma Policy Institute

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

How Oklahoma Taxes Compare Oklahoma Policy Institute

State Says Income Tax Exemption For Tribal Citizens On Reservations Inapplicable Despite Existing Law